Health Insurance Companies and Plans

Quick Links

- Health Insurance Companies

- Health Insurance Agencies

- How Health Insurance Works

- Importance of Health Insurance

- How to Claim Health Insurance

- How much Insurance Do I Need

- Does Health Insurance Cover Pregnancy

- How to Choose Health Insurance

- Does Health Insurance Premium Increase Every Year

- Is Health Insurance Tax Deductible

- Health Insurance Monthly Plans in India

- Health Insurance Quotation Format

- Health Insurance Zones in India

- Is Dental Treatment Covered in Health Insurance?

- Is Cancer Treatment Covered in Health Insurance?

- How to Port Health Insurance

- Health Insurance vs Term Insurance

- Health Insurance Age Limit

- Health Insurance Claim Settlement Ratio

- Health Insurance Family Plans

- Health Insurance by Governement of India

- Health Insurance Lock In Period

- Health Insurance Nominee: Importance Guidelines

- Health Insurance vs Life Insurance

- Health Insurance vs Medical Insurance

In today’s fast-paced world, health insurance is not just a luxury but a necessity. With rising medical costs and unpredictable health issues, investing in the right health insurance plans is essential for financial security and peace of mind. Whether you’re an individual, a family person, or a senior citizen, there’s a health insurance policy tailored just for your needs. In this guide, we’ll explore some of the top health insurance companies in India, their popular health insurance plans, and why you should consider them.

1. Star Health Insurance

Star Health Insurance is one of the most trusted health insurance companies in India. Known for its customer-friendly services and diverse product offerings, Star Health offers comprehensive health insurance plans suitable for all age groups.

Popular Health Insurance Plans by Star Health:

- Star Comprehensive Health Insurance Plan; Offers coverage up to ₹1 crore, with maternity benefits, newborn cover, and health check-ups included.

- Family Health Optima Insurance Plan: A cost-effective health insurance plan for families that covers hospitalization, daycare procedures, and emergency ambulance.

- Senior Citizens Red Carpet Plan: Tailored for individuals above 60 years, this plan offers hassle-free coverage without pre-medical screening.

- Star Health Assure Plan: A flexible policy that provides restoration of the sum insured, wellness services, and global cover in select cases.

All these health insurance plans provide pre and post-hospitalization cover, cashless treatment, and access to a wide network of hospitals.

2. Policybazaar

Policybazaar is a leading aggregator platform where you can compare, buy, and manage health insurance plans from multiple insurers. It doesn’t underwrite its own insurance but acts as a bridge between users and insurance providers.

Features of Health Insurance via Policybazaar:

- Compare over 100+ health insurance plans side by side.

- Customize your plan based on needs like maternity, critical illness, or senior citizen health insurance.

- Get expert assistance and policy recommendations.

Some top plans available on Policybazaar include:

- Care Health Insurance

- Niva Bupa Health Insurance

- Aditya Birla Health Insurance

- Tata AIG Health Insurance

Using Policybazaar helps in making an informed decision when buying health insurance in India.

3. HDFC ERGO Health Insurance

HDFC ERGO is a prominent name in the health insurance sector, offering a wide range of health insurance plans to suit individuals, families, and senior citizens.

Popular Health Insurance Plans from HDFC ERGO:

- My:Health Suraksha Plan: Offers hospitalization cover, pre- and post-hospitalization benefits, and free health check-ups.

- Optima Restore Plan: Automatically restores 100% of the sum insured if it gets exhausted during the policy year.

- Critical Illness Insurance: Offers a lump sum payout on diagnosis of listed critical illnesses like cancer, stroke, or kidney failure.

- Energy Health Insurance Plan: Designed for people with diabetes and hypertension, it includes wellness coaching and health tracking.

HDFC ERGO also provides cashless treatment across 12,000+ hospitals in India, making it a solid choice for health insurance buyers.

4. Acko Health Insurance

Acko is a digital-first health insurance company that offers simplified and affordable health insurance plans. Known for zero paperwork and instant policy issuance, Acko is great for tech-savvy customers.

Popular Health Insurance Plans by Acko:

- Acko Platinum Health Plan: Covers hospitalization, daycare procedures, and offers zero deductions on claims.

- Acko Standard Health Plan: Affordable plan with essential health coverage and benefits like cashless hospitalization.

- Group Health Insurance: Perfect for startups and SMEs, providing customizable health benefits for employees.

With an easy-to-use mobile app, 24×7 claims support, and paperless transactions, Acko is ideal for those seeking convenience in their health insurance experience.

5. ICICI Lombard Health Insurance

ICICI Lombard is one of the most reliable health insurance providers in India, offering comprehensive plans that cater to a variety of customer needs.

Popular Health Insurance Plans by ICICI Lombard:

- Complete Health Insurance Plan: Provides coverage for hospitalization, day care treatments, and critical illnesses.

- Health AdvantEdge Plan: Offers global coverage, wellness benefits, and emergency air ambulance services.

- Corona Kavach Policy: Designed specifically to cover COVID-19-related expenses.

ICICI Lombard’s cashless hospitalization facility across 6,500+ hospitals and wellness benefits makes it a strong contender in the health insurance space.

6. Bajaj Finserv Health Insurance

Bajaj Finserv provides access to a wide array of health insurance plans under one platform. It also allows users to buy health insurance from multiple leading insurers with added financing options.

Popular Health Insurance Options Available:

- Bajaj Allianz Health Guard: Covers pre- and post-hospitalization, maternity expenses, and ambulance services.

- Health Ensure Plan: Affordable entry-level health insurance plan with basic health coverage.

- Top-up and Super Top-up Plans: Great for individuals who already have employer health coverage but want higher protection.

You can also use EMI options to pay for your health insurance plans, making high-value coverage more accessible.

7. Axis Health Insurance

Axis Bank, in collaboration with Max Life Insurance, offers reliable and flexible health insurance plans. Their policies are ideal for both salaried individuals and business owners who want long-term health security.

Key Health Insurance Plans:

- Axis Max Life Secure Health Plan: Offers financial protection against critical illnesses such as cancer, stroke, and heart conditions. You receive a lump-sum payout on diagnosis.

- Axis Max Life Critical Illness Plan: Covers 40+ critical illnesses with tax benefits under Section 80D. This health insurance plan is suitable for people with a family history of lifestyle diseases.

These plans ensure comprehensive protection, with options for enhanced cover through riders and wellness benefits.

8. Tata AIG Health Insurance

Tata AIG is one of the leading health insurance companies in India offering both individual and group health insurance policies. Known for excellent customer support and a strong claim settlement ratio, Tata AIG has built trust over the years.

Key Health Insurance Plans:

- Tata AIG MediCare Plan: Offers all-inclusive hospitalization coverage, including pre- and post-hospitalization, organ donor expenses, and daycare treatments.

- Tata AIG MediCare Protect: A more affordable variant for young individuals and small families with a lower premium yet robust protection.

- Tata AIG Arogya Sanjeevani Policy: A government-standardized health insurance plan providing basic coverage for common ailments and hospitalization.

Tata AIG’s wide hospital network, cashless claim services, and no-claim bonus make it a go-to option for modern families.

9. SBI General Health Insurance

Backed by one of India’s largest banking institutions, SBI General Insurance provides reliable and flexible health insurance plans. With options for individuals, families, and corporate groups, their offerings are vast and accessible.

Popular Health Insurance Plans:

- SBI Arogya Supreme Polic: Provides coverage up to ₹5 crore. Includes multiple sum insured restoration, hospitalization expenses, and coverage for 20+ advanced treatments.

- SBI Critical Illness Insurance: Offers a lump-sum payout on diagnosis of any of the 13 listed critical illnesses.

- SBI Arogya Top-up Plan: Ideal for those with employer-provided insurance who want additional coverage.

SBI General Health Insurance plans offer affordable premiums and a vast hospital network across India.

10. ManipalCigna Health Insurance

ManipalCigna is a joint venture between the Manipal Group and Cigna Corporation, offering customer-centric health insurance plans. Their products are designed with modern lifestyle challenges and chronic conditions in mind.

Notable Health Insurance Plans:

- ManipalCigna ProHealth Prime: Covers all hospitalization costs with zero deductions and full restoration benefits. It includes worldwide emergency cover as well.

- ManipalCigna Lifetime Health: Offers lifetime renewability, global health coverage, and add-on options for maternity and wellness.

- ManipalCigna Super Top-Up Plan: Helps enhance existing health insurance by increasing the sum insured at a low cost.

With over 6,500 network hospitals and digital claim processing, ManipalCigna is one of the fastest-growing health insurance companies in India.

11. InsuranceDekho

InsuranceDekho is a digital platform that allows users to compare and buy health insurance plans from top insurers in India. While not a direct provider, its strength lies in transparency, ease of comparison, and simplified buying processes.

Features and Offerings:

- Compare plans from 30+ insurers including HDFC Ergo, Star Health, and Niva Bupa.

- Buy health insurance for individuals, families, senior citizens, and critical illness coverage.

- 24×7 customer support and policy renewal reminders.

You can select the best health insurance plan based on premiums, coverage, and hospital networks, making InsuranceDekho a one-stop platform for smart insurance decisions.

12. NHA Gov India – PM-JAY

Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (PM-JAY) is a government-backed health insurance scheme offered by the National Health Authority (NHA). It targets the economically vulnerable sections of society and offers completely cashless and paperless services.

Highlights of PM-JAY:

- Covers up to ₹5 lakh per family per year for secondary and tertiary hospitalization.

- Includes over 1,500 medical packages across 24 specialties.

- Beneficiaries can access services across public and empaneled private hospitals in India.

This initiative has transformed access to health insurance for low-income families and remains one of the largest health protection schemes in the world.

13. Aditya Birla Health Insurance

Aditya Birla Health Insurance is known for integrating wellness with insurance. Their innovative health insurance plans encourage healthy behavior through rewards and wellness points.

Top Health Insurance Plans:

- Activ Health Platinum Plan: Offers chronic management programs, wellness coaching, and 100% reload of the sum insured. Comes with the “HealthReturns™” benefit that gives cashback for staying fit.

- Activ Assure Diamond Plan: Covers hospitalization, day care procedures, pre- and post-hospitalization, and critical illness.

- Activ Care for Senior Citizens: Designed for older adults with additional coverage for comorbidities and fast-track claim processing.

With fitness-linked premium discounts and teleconsultation benefits, Aditya Birla combines health insurance with lifestyle improvement.

14. Niva Bupa Health Insurance

Formerly known as Max Bupa, Niva Bupa Health Insurance is among the most reputed health insurance companies in India. They are known for quick claim settlement and easy online access to health insurance plans.

Top Health Insurance Plans:

- Niva Bupa ReAssure 2.0: Offers unlimited reinstatement of sum insured, cashless hospitalization, and wellness benefits.

- Health Companion Plan: Great for families and individuals; includes OPD cover, maternity benefits, and day care procedures.

- GoActive Health Insurance Plan: Designed for millennials and working professionals, offering features like cashless OPD, online doctor consultation, and second medical opinions.

Niva Bupa stands out for its 30-minute cashless claim processing promise and wide hospital network.

Final Thoughts: Choosing the Right Health Insurance Plan in India

Choosing the right health insurance provider depends on your personal needs—be it affordability, comprehensive benefits, critical illness coverage, or senior citizen care. The Indian health insurance market offers a range of options from private players like Axis, Tata AIG, and Aditya Birla to digital platforms like InsuranceDekho, and government initiatives like PM-JAY.

Here are a few tips for selecting the best health insurance:

- Assess your needs: Consider age, lifestyle, family history, and budget.

- Compare policies: Use platforms like Policybazaar or InsuranceDekho.

- Check network hospitals: Ensure your preferred hospitals are in-network.

- Look for value-adds: Such as health checkups, teleconsultations, and wellness rewards.

- Read the fine print: Understand waiting periods, exclusions, and claim processes.

The right health insurance plan gives you more than just coverage—it offers peace of mind.

Health Insurance Agencies

How Health Insurance Works: A Complete Guide

Health insurance is a contract between a policyholder and an insurance company that covers medical expenses. Whether it’s hospitalization, medication, diagnostic tests, or doctor consultations, a health insurance plan provides financial protection when you need it most. In today’s world, medical costs are rising steadily, and having the right health insurance is not a luxury but a necessity. Let’s understand how health insurance works in detail.

What is Health Insurance?

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It can also cover routine health check-ups, daycare procedures, pre- and post-hospitalization costs, and critical illnesses, depending on the health insurance plan you choose.

In a health insurance plan, the policyholder pays a premium (monthly, quarterly, or annually), and in return, the insurer covers certain medical expenses as defined in the policy document. The extent of the coverage, premium, and benefits vary based on the health insurance plan selected.

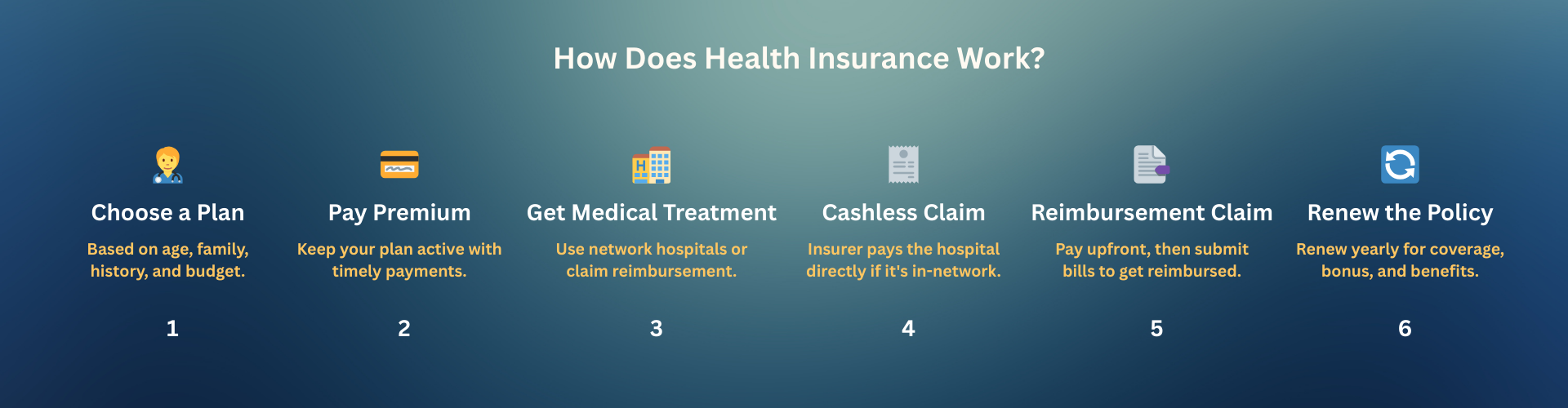

How Does Health Insurance Work?

Key Features of a Health Insurance Plan

Sum Insured: The maximum amount the health insurance company will pay during the policy term.

Pre- and Post-Hospitalization: Many health insurance plans cover medical expenses before and after hospitalization for a certain number of days.

Daycare Procedures: Treatments that don’t require 24-hour hospitalization are covered in modern health insurance plans.

Maternity and Newborn Cover: Some health insurance plans include maternity benefits and cover for newborns.

Tax Benefits: Premiums paid towards a health insurance plan are eligible for tax deductions under Section 80D of the Income Tax Act.

Why You Need Health Insurance

Medical emergencies are unpredictable and can drain your finances. A good health insurance plan ensures you receive timely treatment without worrying about costs. It offers peace of mind, better healthcare access, and financial security. Moreover, with the growing rate of lifestyle diseases and rising treatment costs, health insurance becomes crucial at every stage of life.

Understanding how health insurance works is the first step in protecting your health and finances. By choosing the right health insurance plan, you can ensure comprehensive coverage for yourself and your family. Make sure to compare policies, read the fine print, and invest in a health insurance plan that suits your medical and financial needs. Start today, because the right health insurance can make all the difference in times of need.

Why Health Insurance Is Important: A Vital Financial Safety Net

In today’s fast-paced world, health risks have become more common due to lifestyle changes, pollution, stress, and genetic conditions. Amid rising medical inflation, one unexpected health emergency can burn a deep hole in your pocket. This is where health insurance plays a vital role. Having a health insurance plan is no longer optional—it’s a necessity. Let’s explore the reasons why health insurance is important and how it serves as a powerful tool for financial and physical well-being.

1. Protection Against Medical Expenses

The primary reason health insurance is important is that it shields you from the burden of high medical bills. A single hospitalization for a critical illness or surgery can cost several lakhs. A good health insurance plan covers hospitalization, surgeries, diagnostic tests, medicines, and even post-hospitalization expenses. Whether it’s a planned procedure or an emergency, health insurance helps reduce out-of-pocket costs drastically.

2. Cashless Treatment Facility

Most health insurance plans offer cashless treatment at network hospitals. This means you don’t have to worry about arranging funds during a medical emergency. The hospital directly coordinates with your health insurance provider, and your treatment is taken care of without upfront payments—offering relief during stressful times.

3. Covers a Wide Range of Services

Modern health insurance plans offer more than just hospitalization coverage. They often include:

- Pre- and post-hospitalization expenses

- Daycare treatments

- Critical illness coverage

- Ambulance charges

- Maternity benefits

- Wellness programs and annual health check-ups

Such comprehensive coverage makes health insurance a holistic healthcare solution.

4. Financial Stability for You and Your Family

An illness or accident can impact your family’s finances significantly. A health insurance plan ensures that your savings stay intact and your family remains financially secure during medical crises. It eliminates the need to borrow money or sell assets to cover treatment costs.

5. Peace of Mind in Uncertain Times

Knowing that you and your loved ones are covered under a health insurance plan brings immense peace of mind. You can focus on recovery instead of worrying about how to afford the treatment. This emotional comfort is one of the less talked about, yet most important benefits of health insurance.

6. Tax Benefits Under Section 80D

Another reason why health insurance is important is the tax-saving advantage. Premiums paid towards a health insurance plan are eligible for deductions under Section 80D of the Income Tax Act. You can claim up to ₹25,000 (₹50,000 for senior citizens), helping you save money while securing your health.

7. Access to Quality Healthcare

With health insurance, you get access to better healthcare facilities and treatments. Most health insurance providers have partnerships with top hospitals and specialists. This ensures timely and quality care—something that might otherwise be delayed due to cost concerns.

8. Lifestyle Diseases and Health Risks

Conditions like diabetes, hypertension, heart disease, and cancer are on the rise, even among younger individuals. Having a health insurance plan ensures you’re covered against such illnesses, allowing for early intervention, regular monitoring, and long-term support.

9. Customizable Plans for Every Need

Today’s health insurance plans can be tailored to suit specific needs—whether you’re buying for an individual, your parents, or your entire family. There are also special plans for senior citizens, maternity, top-ups, and super top-ups to enhance your existing coverage.

To sum it up, health insurance is more than just a policy—it’s a safety net that protects your health and wealth. It offers financial security, access to quality healthcare, and peace of mind during uncertain times. A well-chosen health insurance plan ensures that you’re always prepared for the unexpected. So, don’t wait for a medical emergency to strike—invest in a health insurance plan today and secure a healthier tomorrow.

How to Claim Health Insurance: A Step-by-Step Guide

Having a health insurance plan offers peace of mind, but knowing how to claim health insurance is just as important. Whether it’s a planned surgery or a medical emergency, understanding the health insurance claim process helps you avoid delays and ensures you get the benefits you’re entitled to. In this guide, we explain how to claim health insurance in India—step by step—for both cashless and reimbursement claims.

Types of Health Insurance Claims

There are two primary ways to claim health insurance under a health insurance plan:

- Cashless Claim – You get treatment at a network hospital, and the health insurance company settles the bill directly with the hospital.

- Reimbursement Claim – You pay for the treatment first, then file a claim with your health insurance provider to get reimbursed.

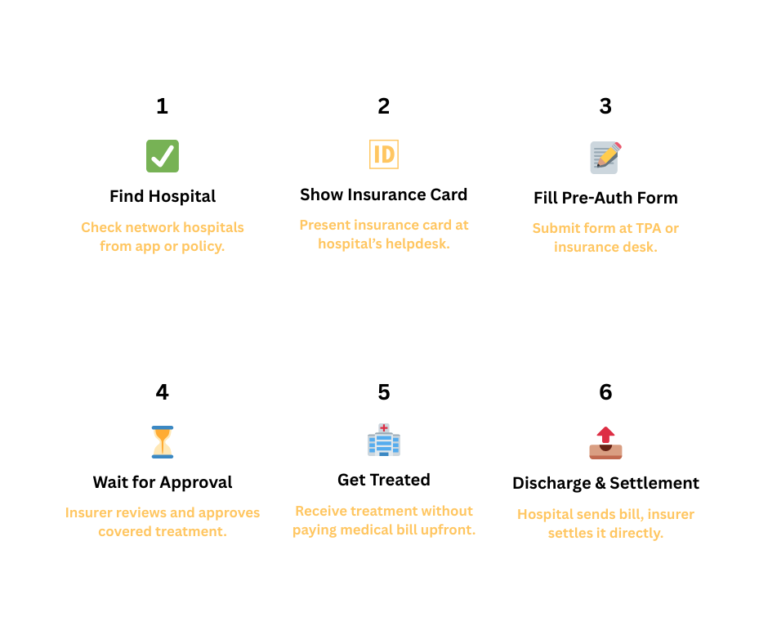

✅ How to Claim Health Insurance – Cashless Claim Process

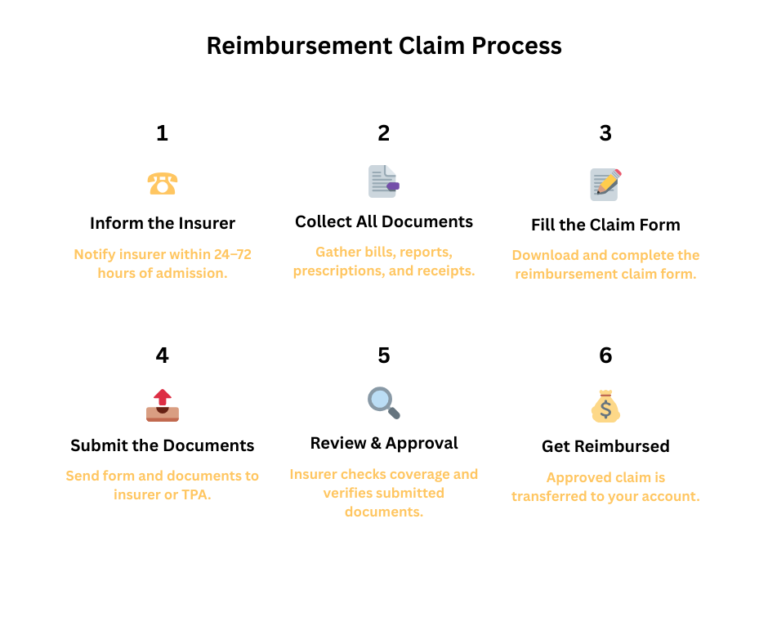

✅ How to Claim Health Insurance – Reimbursement Claim Process

Documents Required for Health Insurance Claim

Regardless of the method, these documents are generally required for a health insurance claim:

- Health Insurance ID Card / Policy Copy

- Claim Form (duly filled and signed)

- Hospital Bills (originals)

- Discharge Summary

- Prescriptions & Pharmacy Bills

- Diagnostic Test Reports

- Cancelled Cheque (for reimbursement)

Common Reasons for Health Insurance Claim Rejection

- Claiming for excluded treatments

- Submitting incomplete or incorrect documents

- Delay in intimation or submission

- Policy lapsed or expired health insurance plan

- Misrepresentation or fraud

Claiming your health insurance is easy if you follow the right steps and keep your documents ready. Whether you go for a cashless facility at a network hospital or choose reimbursement at a non-network one, it’s essential to understand the process thoroughly. A good health insurance plan not only protects you during emergencies but also makes the claims process hassle-free. Keep your insurer’s contact handy, know your policy terms, and stay informed to make the most of your health insurance benefits.

How Much Health Insurance Do I Need? A Smart Guide for Choosing the Right Coverage

Choosing the right health insurance plan is not just about picking the cheapest premium—it’s about securing enough coverage for unexpected medical needs. But how much health insurance is enough? The answer depends on various personal and financial factors. In this guide, we’ll help you understand how much health insurance you really need to protect your health and wealth.

Why Choosing the Right Coverage Matters

Medical costs are rising rapidly. A major surgery, prolonged illness, or critical care treatment can cost several lakhs. If your health insurance plan has a low sum insured, it may not be enough to cover your total expenses—forcing you to dip into savings. On the other hand, too much health insurance might lead to unnecessarily high premiums.

The goal is to strike the right balance—choosing a health insurance plan that covers possible medical expenses without being a financial burden.

Key Factors to Decide How Much Health Insurance You Need

1. Your Age

Age is a major factor in choosing the right health insurance coverage. Younger individuals (below 30) might start with a basic health insurance plan of ₹5 to ₹10 lakhs, while those above 40 should opt for higher coverage (₹15 to ₹25 lakhs), considering higher risks of lifestyle diseases.

2. Family Size

If you’re buying a family floater health insurance plan, your sum insured should be enough to cover multiple members. For a family of four, coverage of ₹20 lakhs or more is generally recommended, especially in metro cities where healthcare costs are higher.

3. City of Residence

Living in a metro like Mumbai, Delhi, or Bangalore? Healthcare costs in urban areas are significantly higher. So, your health insurance coverage must reflect the actual cost of treatments in your location. A ₹5 lakh health insurance plan might not go far in such cities.

4. Medical History

If you or your family members have pre-existing conditions like diabetes, heart disease, or hypertension, you need a health insurance plan with higher coverage and critical illness add-ons. These conditions often require long-term care, surgeries, or hospital stays.

5. Lifestyle and Risk Exposure

Your job and lifestyle also play a role. Frequent travelers, corporate professionals with sedentary lifestyles, or people with high stress levels may be more prone to health issues. A comprehensive health insurance plan with additional riders for wellness, chronic illnesses, or accidents is ideal.

Ideal Health Insurance Coverage: The 50% Rule

A common thumb rule is that your health insurance plan should cover at least 50% of your annual income. So if you earn ₹10 lakhs per year, you should ideally have a health insurance cover of ₹5 lakhs minimum. But if you’re above 40, have dependents, or live in a metro, aim for ₹15 to ₹25 lakhs coverage.

Consider Super Top-Up Plans

Instead of relying on a single high-premium policy, you can combine a basic health insurance plan with a super top-up plan. For example:

- Base Plan: ₹5 lakhs

- Super Top-Up: ₹20 lakhs (with ₹5 lakh deductible)

This combo gives you ₹25 lakhs coverage at a much lower cost compared to buying a ₹25 lakh base plan alone.

Include Add-Ons for Complete Coverage

- Critical Illness Rider

- Maternity Cover

- OPD & Diagnostic Benefits

- Room Rent Waiver

- Personal Accident Cover

Adding these to your health insurance plan can give you extended protection without significantly increasing your premium.

So, how much health insurance do you need? It depends on your age, lifestyle, location, and family size. A good health insurance plan provides peace of mind and financial security during medical emergencies. Don’t underestimate the risks—choose a plan that offers adequate coverage, and review it regularly to match your changing life needs.

Does Health Insurance Cover Pregnancy? What You Need to Know

Pregnancy is one of the most life-changing phases in a person’s life—and it comes with both emotional joy and financial responsibilities. One of the most common questions couples ask is: “Does health insurance cover pregnancy?” The good news is that many modern health insurance plans do offer maternity coverage, but there are important details you should know before you buy or claim a health insurance policy for pregnancy-related expenses.

Yes, Health Insurance Can Cover Pregnancy

In India, several health insurance plans come with maternity benefits. These plans cover pregnancy-related medical expenses, including hospitalization for delivery (normal or C-section), pre- and post-natal care, and sometimes even newborn baby coverage.

However, not all health insurance plans include this by default. Maternity cover is often an add-on rider or available only in specific policies designed for young couples and families.

What is Covered Under Pregnancy Health Insurance?

Here’s what’s generally included in a health insurance plan that covers pregnancy:

- Hospitalization for Delivery: Both normal and cesarean deliveries are covered up to a certain limit.

- Pre- and Post-Natal Expenses: Doctor consultations, ultrasounds, medications, and follow-up visits are often included.

- Newborn Baby Cover: Many health insurance plans cover the newborn for a limited duration (usually 90 days) from birth.

- Daycare Procedures: Minor procedures like vaccinations may be covered under select health insurance policies.

- Ambulance Charges: Some health insurance plans also include ambulance costs during emergencies related to delivery.

What is Not Covered in Maternity Health Insurance?

Even if your health insurance plan covers pregnancy, some exclusions apply:

- Waiting Period: Most health insurance plans have a waiting period of 9 months to 3 years before you can claim maternity benefits. You must plan ahead and buy your policy early.

- Pre-Existing Pregnancies: If you’re already pregnant at the time of buying the health insurance plan, most insurers won’t cover the maternity expenses.

- Fertility Treatments: IVF, IUI, or other fertility procedures are usually excluded unless explicitly mentioned.

- Non-Allopathic Treatments: Expenses for Ayurveda, Homeopathy, or other alternative therapies may not be included.

Best Time to Buy Health Insurance for Pregnancy

To fully benefit from a health insurance plan that includes maternity cover, buy the policy before planning a pregnancy. This helps you complete the waiting period and enjoy maximum coverage without rejection.

Tips to Choose the Right Pregnancy Health Insurance Plan

- Check Waiting Period: Opt for a health insurance plan with the shortest waiting period possible.

- Look for Newborn Cover: Choose a plan that offers coverage for the baby from day one.

- Hospital Network: Ensure the insurer’s network includes maternity hospitals near you for cashless claims.

- Limit and Sub-Limit: Understand the maximum amount the health insurance provider will pay for delivery expenses.

- Add-on Riders: Explore riders like pregnancy complications, OPD consultations, and vaccination benefits.

So, does health insurance cover pregnancy? Yes—but only if you choose the right health insurance plan with maternity benefits and purchase it early. A well-planned health insurance policy can help you manage delivery and newborn expenses without financial stress. From doctor visits to hospital charges and postnatal care, a good health insurance plan ensures you focus on welcoming your baby rather than worrying about the bills.

How to Choose Health Insurance: A Complete Guide for Smart Buyers

Choosing the right health insurance can be confusing, especially with so many options available in the market. From premiums and coverage to network hospitals and claim processes, every detail matters when picking the best health insurance plan for you and your family. In this guide, we’ll explain how to choose health insurance step by step so you can make a smart, informed decision that protects your health and finances.

Why Choosing the Right Health Insurance Matters

The right health insurance plan provides financial protection against rising medical costs. It ensures access to quality healthcare during emergencies and helps you avoid dipping into your savings or going into debt. However, not all health insurance plans are created equal. Choosing poorly can lead to claim rejections, low coverage, or high out-of-pocket costs.

Step-by-Step Guide to Choose the Best Health Insurance Plan

1. Assess Your Needs

Start by evaluating your personal and family health needs:

- Are you single or buying a family health insurance plan?

- Do you have any pre-existing conditions?

- Are you planning a pregnancy?

- How often do you visit hospitals or need medications?

Your answers will help determine the kind of health insurance coverage you need.

2. Choose Between Individual and Family Floater

- Individual Health Insurance: Covers one person. Ideal for people with specific health risks or elderly individuals.

- Family Floater Health Insurance: Covers all family members under one health insurance plan. More cost-effective for young, healthy families.

3. Check the Sum Insured (Coverage Amount)

A good health insurance plan should offer adequate coverage to handle major medical expenses. In India, a coverage of ₹10–25 lakhs is recommended for metro cities, while ₹5–10 lakhs might be enough in smaller towns. Consider inflation and future medical costs when deciding.

4. Understand the Waiting Period

Most health insurance plans have waiting periods for:

- Pre-existing diseases (typically 2–4 years)

- Maternity and newborn cover (9 months to 3 years)

- Specific treatments like hernia, piles, etc.

Choose a health insurance provider with the shortest waiting period if you need immediate benefits.

5. Check Network Hospitals

Look for a health insurance provider with a wide network of hospitals offering cashless treatment. A strong network ensures smooth and fast claims, especially during emergencies.

6. Compare Premium vs. Benefits

Don’t just choose the cheapest plan. Compare the premium with the benefits offered—like room rent limits, co-pay clauses, ambulance charges, and daycare procedure coverage. A slightly higher premium may offer far better coverage.

7. Look for Add-On Benefits

Many health insurance plans offer valuable add-ons:

- Critical illness cover

- Maternity benefits

- OPD and diagnostics cover

- Personal accident cover

- No-claim bonus

Choose a health insurance plan with relevant add-ons that enhance your overall protection.

8. Understand the Claim Settlement Ratio

A high claim settlement ratio means the insurer approves most claims. Look for health insurance companies with a ratio above 90%. It’s a sign of reliability and trust.

9. Read the Fine Print

Every health insurance plan has exclusions—treatments and scenarios it won’t cover. Always read the policy document carefully and clarify doubts with the insurer before purchasing.

10. Use Online Tools for Comparison

Leverage comparison websites to evaluate features, reviews, and costs of different health insurance plans side by side. This will help you find the best match for your budget and needs.

Choosing the right health insurance isn’t just about buying a policy—it’s about protecting your future. A thoughtfully selected health insurance plan offers security, access to quality care, and peace of mind for you and your family. Evaluate your needs, compare plans, understand the terms, and make sure your chosen health insurance truly supports you when you need it the most.

Does Health Insurance Premium Increase Every Year? Everything You Should Know

One of the most common concerns among policyholders is: “Does health insurance premium increase every year?” The short answer is—yes, it can. But there are specific reasons why your health insurance premium may go up annually, and understanding these can help you manage your health insurance plan better and avoid unexpected hikes.

In this article, we break down why health insurance premiums change over time and what you can do to control your premium costs.

What is a Health Insurance Premium?

A health insurance premium is the amount you pay periodically (usually yearly) to keep your health insurance plan active. In return, the insurer covers your medical expenses up to a certain limit. The premium is based on several factors such as age, coverage amount, medical history, and more.

Why Does Health Insurance Premium Increase Every Year?

While health insurance plans are generally designed to offer long-term coverage, the premium may not remain the same year after year. Here’s why your health insurance premium may increase annually:

1. Age-Based Premium Slabs

Most health insurance plans use age slabs to calculate premiums. As you move into a higher age bracket (like from 30–35 to 36–40), your health insurance premium increases. This is because older individuals are statistically more likely to need medical care.

2. Medical Inflation

The cost of healthcare in India is rising at a rate of 8–10% every year. This includes doctor consultation fees, hospital charges, diagnostic tests, and medicines. To keep up with these rising costs, health insurance companies may revise their pricing.

3. Policy Upgrades

If you upgrade your health insurance plan to a higher sum insured or add riders like maternity, critical illness, or personal accident cover, your premium will increase accordingly.

4. Claims History

Some insurers consider your past claim history. If you’ve made frequent or high-value claims in the previous year, your health insurance premium may go up. However, this varies by insurer.

5. Changes in Government Regulations or Taxes

If there are new IRDAI guidelines or changes in GST rates, it could affect the pricing of your health insurance plan. In such cases, the insurer may pass on the additional cost to customers.

Can You Lock in the Premium for Health Insurance?

Some insurers offer long-term health insurance plans with 2 or 3-year tenures. By opting for these, you can lock in your health insurance premium for that period and avoid annual hikes.

Also, young buyers can enjoy lower premiums for many years by purchasing health insurance early and renewing on time without breaks.

How to Manage Rising Health Insurance Premiums

- Buy Early: The earlier you buy a health insurance plan, the lower the premium.

- Avoid Frequent Claims: Small expenses can be paid out-of-pocket. Avoid unnecessary claims to maintain a good track record.

- Compare Plans Regularly: If your insurer increases the premium, compare it with other health insurance providers.

- Choose Plans with NCB: No Claim Bonus (NCB) rewards you with increased coverage without increasing premiums.

So, does health insurance premium increase every year? Yes, it often does—due to factors like age, inflation, claims, and policy changes. However, with smart planning and the right health insurance plan, you can minimize or even delay these increases. Always review your health insurance coverage annually and compare policies to ensure you’re getting the best value.

Is Health Insurance Tax Deductible? Here’s What You Need to Know

When it comes to managing finances, many individuals often overlook the tax-saving potential of health insurance. One common and important question people ask is: “Is health insurance tax deductible?”

The answer is yes—in India, the premium paid for a health insurance plan qualifies for a tax deduction under Section 80D of the Income Tax Act, 1961.

Let’s explore how you can use your health insurance plan not just for medical protection but also for reducing your tax liability effectively.

What is Section 80D?

Section 80D of the Income Tax Act allows individuals and Hindu Undivided Families (HUFs) to claim tax deductions on premiums paid for health insurance. This includes:

- Individual health insurance plans

- Family floater health insurance plans

- Health insurance for parents

- Top-up and super top-up health insurance plans

- Preventive health check-ups

Tax Deduction Limits for Health Insurance

Here’s a detailed breakdown of how much deduction you can claim for health insurance premiums under Section 80D:

| Covered Persons | Maximum Deduction Allowed |

|---|---|

| Self, spouse, and dependent children | ₹25,000 |

| Parents (below 60 years) | ₹25,000 |

| Parents (senior citizens above 60 years) | ₹50,000 |

| Self + Family + Senior Citizen Parents | ₹75,000 |

| Self (senior citizen) + Senior Citizen Parents | ₹1,00,000 |

So, if you buy a health insurance plan for yourself and your senior citizen parents, you can claim up to ₹1,00,000 as a tax deduction.

Preventive Health Check-Up Deduction

Out of the ₹25,000 or ₹50,000 limit, you can also claim up to ₹5,000 for preventive health check-ups. This means that even if you haven’t bought a new health insurance plan, getting an annual check-up can still help you save on taxes.

Who Can Claim the Tax Deduction?

You can claim tax benefits on a health insurance plan if:

- You are an individual or part of a Hindu Undivided Family (HUF)

- The premium is paid through non-cash modes (online, cheque, UPI, etc.)

- The policy covers self, spouse, children, or parents

Cash payments for premium are not eligible for tax deduction under Section 80D, except for preventive health check-ups.

What Types of Health Insurance Qualify?

You can claim tax deductions on most types of health insurance plans, including:

- Individual health insurance

- Family floater plans

- Senior citizen health insurance

- Critical illness health insurance

- Top-up and super top-up plans

Make sure the health insurance policy is from an IRDAI-approved insurer.

Tax Deduction for Employers and Businesses

If you’re self-employed or a business owner, health insurance premiums paid for employees are considered a business expense under Section 37(1). However, personal health insurance still falls under Section 80D.

Can You Claim for Multiple Health Insurance Plans?

Yes. If you have more than one health insurance plan (like an individual plan and a top-up), you can claim deductions on all eligible premiums, provided the total limit under Section 80D is not exceeded.

So, is health insurance tax deductible? Absolutely. In addition to safeguarding your health, a health insurance plan offers a great way to reduce your taxable income. By making smart decisions and understanding the rules under Section 80D, you can maximize both your health insurance coverage and your tax savings.

Is Dental Treatment Covered in Health Insurance? Know the Truth Before You Buy

When people invest in a health insurance plan, they often assume it will cover all types of medical treatments—including dental. However, the reality is slightly different. One of the most frequently asked questions by policyholders is: “Is dental treatment covered in health insurance?” The answer is: not always, and when it is, there are specific conditions attached.

In this guide, we’ll explore whether health insurance includes dental treatment, what kind of dental expenses are covered (if any), and how you can get coverage for dental care under your health insurance plan.

Does Health Insurance Cover Dental Treatment?

In general, most health insurance plans in India do not cover routine dental treatments. Procedures like scaling, cleaning, cavity filling, and cosmetic dentistry are often excluded from regular health insurance policies. However, there are exceptions where dental treatments are covered under specific circumstances.

When is Dental Treatment Covered Under Health Insurance?

Here are the conditions where health insurance may cover dental procedures:

1. Accident-Related Dental Injuries

If you suffer a dental injury due to an accident—like a road mishap or sports injury—your health insurance plan may cover the cost of treatment, including surgery or tooth reconstruction.

2. Post-Surgical Dental Treatments

If dental care is part of a larger surgery or medical treatment (e.g., jaw surgery or cancer treatment affecting the mouth), your health insurance may cover related dental procedures.

3. Hospitalization for Dental Surgery

Some health insurance plans cover dental surgery if hospitalization is required. For example, wisdom tooth extraction under general anesthesia in a hospital setup might be covered.

4. Specialized Health Insurance Plans

Some insurers now offer customized health insurance plans that include dental benefits. These are usually premium plans or come with add-ons or riders that specifically mention dental cover.

Types of Dental Procedures Usually Not Covered

- Routine dental checkups

- Tooth extraction

- Root canal treatment (RCT)

- Braces or aligners

- Teeth whitening

- Cosmetic dentistry

- Gum treatment (in non-emergency cases)

These are considered non-essential or cosmetic and are excluded from most health insurance policies.

How to Get Dental Coverage Through Health Insurance

If dental health is a priority, consider these options:

1. Opt for Dental Add-Ons

Some insurers provide dental care as an add-on rider to your existing health insurance plan. These riders might cover preventive checkups, X-rays, and even root canal treatment under limits.

2. Corporate Health Insurance

Many corporate health insurance plans offered by employers include basic dental coverage. Check the inclusions in your employee health insurance plan.

3. Standalone Dental Insurance Plans

While rare in India, some insurers are introducing standalone dental insurance that specifically covers dental care. These work similar to standard health insurance, but focus only on dental needs.

Tips Before You Buy Health Insurance for Dental Benefits

- Read the policy document thoroughly to see if dental is covered.

- Clarify exclusions—don’t assume a treatment is covered unless stated.

- Look for cashless dental networks if available.

- Check the claim limits on dental coverage—it is usually capped.

So, is dental treatment covered in health insurance? Not typically—but it can be, under certain conditions like accidents, surgeries, or with specific add-ons. If dental health is a major concern for you or your family, make sure to compare health insurance plans and choose one that offers comprehensive dental benefits or riders.

Remember, a good health insurance plan should cover your overall health needs—including oral health when necessary. So choose wisely and always read the fine print.

Is Cancer Covered in Health Insurance? Here’s What You Must Know

Cancer is one of the most serious health concerns today. With rising medical costs, many people ask, “Is cancer covered in health insurance?” The good news is yes, most comprehensive health insurance plans do offer coverage for cancer treatment. However, the extent of coverage depends on the type of health insurance plan, the policy terms, and any additional riders you may choose.

In this article, we’ll explain how health insurance works for cancer treatment, what’s covered, what’s not, and how to choose the best health insurance plan for cancer care.

Does Health Insurance Cover Cancer?

Most standard health insurance plans cover cancer treatment, but there are limitations. Basic health insurance policies typically cover:

- Hospitalization expenses

- Chemotherapy

- Radiation therapy

- Surgeries related to cancer

- Daycare procedures related to cancer

However, the coverage depends on your health insurance plan’s sum insured, waiting period, sub-limits, and exclusions. You should always read the policy document carefully.

What is Covered Under a Health Insurance Plan for Cancer?

Here’s what a typical health insurance plan may cover when it comes to cancer:

- Pre- and post-hospitalization costs (diagnostic tests, follow-ups)

- In-patient hospitalization (room rent, surgery charges, etc.)

- Cancer treatments like chemotherapy, radiotherapy, and immunotherapy

- Daycare procedures that don’t require 24-hour hospital stay

- Ambulance charges

- Organ donor expenses (in case of organ-related cancer treatment)

Some health insurance plans also offer cashless treatment at network hospitals for cancer.

What is Not Covered?

Even though health insurance covers cancer, there are exclusions and conditions:

- Pre-existing cancer is not covered if diagnosed before buying the health insurance plan

- Waiting period of 30–90 days applies in most cases

- Specific waiting period of 1–4 years may apply to cancer

- Cosmetic or experimental treatments for cancer may not be covered

- Non-allopathic treatments like Ayurveda may not be included unless mentioned

Always check the fine print in your health insurance policy to avoid surprises during claims.

What is Cancer-Specific Health Insurance?

If you want enhanced protection, consider buying a cancer-specific health insurance plan. These plans offer lump-sum payouts upon diagnosis and cover all stages of cancer—early, major, or advanced.

Benefits of a cancer-specific health insurance plan include:

- No claim bonus or increased sum insured every claim-free year

- Fixed benefit payouts for each stage of cancer

- Waiver of premium after diagnosis

- Lower premiums if bought early

These plans can work alongside your regular health insurance to offer added financial support.

How to Choose the Best Health Insurance Plan for Cancer?

When choosing a health insurance plan with cancer coverage, look for:

- High sum insured (₹10–₹50 lakhs recommended)

- Short waiting period

- Lifetime renewability

- No sub-limits on treatments

- Cashless network hospitals

- Critical illness rider with cancer benefits

You can also opt for top-up health insurance plans to boost your existing coverage in case of major treatments like cancer.

So, is cancer covered in health insurance? Yes, but the extent of coverage depends on your health insurance plan. If you have a family history of cancer or want peace of mind, it’s wise to buy a comprehensive health insurance plan with cancer coverage or a specialized cancer insurance policy.

Cancer treatment can be financially draining. A robust health insurance policy ensures you get the best care without worrying about hospital bills. Don’t wait for a medical emergency—compare health insurance plans today and stay protected.

How to Port Health Insurance: A Step-by-Step Guide

Porting health insurance allows policyholders to transfer their existing health insurance policy from one insurer to another, without losing any accumulated benefits like waiting periods or coverage for pre-existing conditions. If you are unsatisfied with your current health insurance provider or want to avail better benefits, health insurance portability can be a great option. Here’s a step-by-step guide on how to port your health insurance:

1. Understand Health Insurance Portability

Health insurance portability is a provision introduced by the Insurance Regulatory and Development Authority of India (IRDAI), which allows policyholders to switch to another insurer while retaining the benefits from the old policy, like waiting periods, no-claim bonuses, and coverage for pre-existing conditions.

It’s important to know that not all policies may be eligible for portability. For example, policies with sub-optimal claim histories or ones with expired coverage periods may not qualify for porting.

2. Evaluate Your Current Health Insurance Policy

Before opting for portability, assess your existing health insurance policy. Review the following factors:

- Premiums: Are the premiums you’re paying reasonable for the coverage you receive?

- Coverage and Exclusions: Are there any exclusions that limit your policy’s benefits?

- Service Quality: Is the current insurance company providing satisfactory claim settlement services?

- No-Claim Bonus: Have you accumulated a no-claim bonus that you’d like to retain when switching?

3. Research Other Health Insurance Providers

Once you decide to port, start researching other insurers. Look for policies that offer:

- Better coverage: Consider coverage that suits your needs, such as family floater policies or critical illness cover.

- Affordable premiums: Compare premiums to find a balance between cost and benefits.

- Good claim settlement ratio: Check the claim settlement ratios of different insurers to ensure they’re reliable.

- Customer service: Evaluate the insurer’s customer service reputation for ease of claim filing and support.

4. Contact the New Insurer

Reach out to the new insurer you are considering for porting your policy. Inform them of your intention to port and provide necessary details about your current policy. This may include:

- Policy number and insurer’s name.

- Medical history and any pre-existing conditions.

- Details of your claim history.

The new insurer will analyze your existing policy and assess the coverage options they can provide.

5. Request Portability from the Current Insurer

Once you’ve chosen your new insurer, you need to inform your current insurer about your intention to port. Typically, you will need to submit a formal request to your current insurer at least 45 days before the renewal date. Make sure to ask for a “Portability Request Form” and fill it out accurately.

You’ll be required to provide:

- A copy of your current health insurance policy.

- Details of any claims you’ve made, including your claim history.

- Proof of premium payment.

6. Wait for the New Insurer’s Offer

The new insurer will evaluate your request and may conduct a medical underwriting process to check if you are eligible for porting. They will send you an offer outlining the terms and conditions, premiums, coverage, and waiting periods. The waiting period may be transferred, and they will factor in your prior insurance coverage when providing a quote.

7. Review the New Policy and Confirm

Carefully read the terms of the new policy, including:

- Premium Amount: Ensure it’s affordable and provides better coverage.

- Coverage Details: Verify that the benefits are in line with what you were expecting.

- Exclusions: Make sure there are no hidden exclusions that could affect your coverage.

Once you’re satisfied with the offer, confirm your acceptance. The new insurer will then send you the final policy documents.

8. Ensure Smooth Transition

Once you’ve completed the porting process, ensure the transition is smooth by keeping the following points in mind:

- Confirm Coverage Continuity: Ensure there is no break in your health coverage between the old policy and the new one.

- Track Waiting Periods: If you had a waiting period under your old policy, confirm that the waiting period is transferred to the new policy.

- Claim History: Make sure the new insurer recognizes any past claims or no-claim bonuses you’ve accumulated.

9. Start Using Your New Policy

Once the process is complete, your new health insurance policy is active, and you can enjoy the benefits of portability. Keep the policy document safe and continue to pay your premiums on time.

Porting health insurance can be a smart decision if you want better coverage, improved service, or lower premiums. By following these steps, you can switch insurers seamlessly while retaining key benefits from your previous policy. Be sure to plan ahead and ensure that there’s no gap in coverage to avoid potential issues when making a claim.

Health Insurance vs Term Insurance: Key Differences Explained

Health insurance and term insurance are two essential types of insurance policies that offer financial protection but serve different purposes. Understanding the key differences between them can help you make the right decision based on your specific needs. Here’s a breakdown of their characteristics:

1. Purpose

- Health Insurance: Health insurance provides coverage for medical expenses incurred due to illness, injury, or hospitalization. It helps cover the cost of doctor visits, hospital stays, surgery, and medications. Some policies also cover preventive care, diagnostic tests, and treatments for chronic conditions.

- Term Insurance: Term insurance is a life insurance policy that provides coverage for a specified term (usually 10, 20, or 30 years). In the event of the policyholder’s death during the term, the beneficiary receives a lump sum payout. However, if the policyholder survives the policy term, there is no payout, and the coverage expires.

2. Coverage

- Health Insurance: Covers medical expenses such as hospitalization, outpatient treatment, surgeries, and sometimes maternity and wellness care. Policies may have add-ons or riders for specific coverage like critical illness, dental, and vision care.

- Term Insurance: Covers the life of the insured person and provides a death benefit to the nominee in case of death during the policy term. It does not cover medical expenses or any health-related issues during the policyholder’s lifetime.

3. Policy Duration

- Health Insurance: Health insurance policies are typically renewable every year and do not have a fixed term. Some policies may provide lifetime coverage, with premiums potentially increasing as you age.

- Term Insurance: Term insurance is a temporary life insurance policy, valid for a specific period (10, 20, 30 years, etc.). If the policyholder outlives the term, the policy ends without any payout.

4. Premiums

- Health Insurance: Premiums for health insurance depend on various factors, including age, health status, sum insured, and type of coverage. Premiums generally increase with age and may also increase with changes in healthcare costs or as you add riders to your policy.

- Term Insurance: Premiums for term insurance are typically fixed for the duration of the policy term. They are generally lower than other forms of life insurance due to the absence of a cash value component. The premium is determined based on the insured’s age, health, and the chosen coverage amount.

5. Benefits

- Health Insurance: Provides financial assistance to cover medical expenses. It can cover hospitalization costs, surgery, pre and post-hospitalization expenses, and even daycare procedures. Some policies also offer cashless hospitalization, network hospital access, and reimbursement for medical bills.

- Term Insurance: The primary benefit of term insurance is the death benefit, which is paid to the beneficiary in case of the policyholder’s death. There are no benefits if the policyholder survives the term. However, the policy offers a significant sum of coverage at an affordable premium.

6. Claim Payout

- Health Insurance: Claims are generally paid based on actual medical expenses incurred, subject to policy limits and terms. If you are hospitalized or need medical treatment, the insurer either pays the hospital directly (cashless treatment) or reimburses the expenses.

- Term Insurance: The claim payout is made as a lump sum to the nominee after the policyholder’s death, provided all conditions of the policy are met. There are no claims for medical expenses, as term insurance is solely focused on life coverage.

7. Tax Benefits

- Health Insurance: Premiums paid for health insurance policies are eligible for tax deductions under Section 80D of the Income Tax Act. This deduction varies based on the age of the insured person and their family members.

- Term Insurance: Premiums paid for term insurance policies are eligible for tax deductions under Section 80C of the Income Tax Act. In case of the policyholder’s death, the nominee also receives the death benefit, which is tax-free under Section 10(10D).

8. Additional Features

- Health Insurance: Health insurance policies may include additional features like maternity cover, critical illness cover, daily cash benefits, free health check-ups, and wellness programs. Some plans may also cover ambulance charges and pre-existing conditions after a waiting period.

- Term Insurance: Term insurance policies are generally straightforward and offer life coverage with no extra benefits. However, some policies may have riders such as critical illness cover or accidental death benefit.

9. Policy Renewal

- Health Insurance: Health insurance policies are usually renewable every year. However, premiums may increase with age or changes in policy terms. Some policies offer lifetime renewability, while others may impose age limits after which renewal is not possible.

- Term Insurance: Term insurance does not require renewal after the initial term expires. If the policyholder wishes to continue coverage, they may need to buy a new policy, often at a higher premium due to age and health changes.

Key Differences at a Glance

While both health insurance and term insurance offer financial security, they cater to different needs. Health insurance is essential for covering medical expenses, while term insurance provides a safety net for your loved ones in case of your untimely death. It’s advisable to have both types of coverage to ensure comprehensive protection—health insurance for your healthcare needs and term insurance for financial security for your family.

Health Insurance Age Limit: What You Need to Know

Health insurance is a critical safeguard against rising medical costs, ensuring that you have financial protection in the event of an illness or accident. However, many individuals are often unsure about the age limits when it comes to purchasing or renewing health insurance. Understanding the age-related criteria for health insurance is vital for securing the right coverage at any stage of life.

1. Age Limits for Buying Health Insurance

Health insurance policies typically have a minimum age requirement and a maximum age limit. These limits can vary depending on the insurer, the type of policy, and the country in which the policy is being purchased.

Minimum Age

The minimum age to purchase health insurance is generally 18 years, as most insurers require the policyholder to be an adult. For policies that include children (like family floater policies), the minimum age for dependents can range from 1 day to 90 days.

- Individual policies: The policyholder must be at least 18 years old to buy an individual health insurance policy.

- Family floater policies: Typically cover individuals ranging from newborns (as young as a few days old) to the elderly (up to the maximum age limit).

Maximum Age

The maximum age limit for purchasing health insurance varies from insurer to insurer. Some health insurance plans may have age limits as low as 60 or 65 years, while others may allow you to buy a policy at higher ages, even up to 80 or 85 years.

- Health Insurance for Seniors: Many insurers offer senior citizen health insurance plans specifically designed for people above 60 years of age. These plans may have higher premiums, but they cater to the specific health needs of elderly individuals.

2. Age Limit for Policy Renewal

In addition to the age limit for purchasing health insurance, it’s also crucial to understand the renewal age limit. Most insurers allow policyholders to continue their health insurance policies after reaching the maximum age limit for new policyholders.

- Renewal Beyond Maximum Age: Some insurers offer lifelong renewal, meaning that even after you reach the age limit, you can continue renewing your policy each year. However, the premium for renewing a health insurance policy at an older age will generally increase due to the higher health risks associated with aging.

- Senior Citizen Health Insurance Plans: Many insurers have tailored policies for senior citizens, and these policies typically come with no upper age limit for renewal as long as the policyholder remains healthy. However, there may be an initial age limit for purchasing these policies.

3. Factors Affecting Age Limits in Health Insurance

Several factors influence the age limits for health insurance, including the type of policy and the insurer’s policies. Here are a few key factors:

Policy Type

- Individual health insurance: Often has a lower maximum age limit, particularly for purchasing new policies.

- Family floater plans: These plans usually cover a family of individuals ranging from young children to senior citizens. The maximum age limit may be higher for family floater policies than for individual policies.

- Critical illness insurance: These policies may have different age limits based on the insurer, with some offering coverage up to 70 years of age.

Insurer’s Terms

Each insurer sets its own criteria for age limits, which can vary widely. For example, some companies may offer health insurance for individuals up to 75 years of age, while others might offer plans for people up to 85 years old.

Health Condition of the Insured

When purchasing or renewing health insurance at an older age, insurers may conduct a medical underwriting process to evaluate the applicant’s health. Older applicants may face higher premiums, exclusions, or limited coverage if they have pre-existing medical conditions.

4. Advantages of Buying Health Insurance at an Early Age

Purchasing health insurance at a younger age offers numerous benefits:

- Lower Premiums: Younger individuals typically pay lower premiums because they have fewer health issues and a lower risk of illness.

- Accumulate No-Claim Bonus: The longer you hold a health insurance policy, the more you can accumulate no-claim bonuses or discounts.

- Coverage for Pre-existing Conditions: If you buy health insurance at a young age, you may avoid waiting periods or exclusions for pre-existing conditions.

- Lifetime Renewal: Some policies offer lifetime renewal benefits, ensuring continuous coverage, even as you age.

5. Health Insurance for Senior Citizens (Above 60 Years)

As people age, their healthcare needs often increase, making health insurance even more critical. Health insurance providers in many countries offer senior citizen health insurance plans designed specifically for individuals above the age of 60.

Key Features of Senior Citizen Health Insurance:

- No Age Limit for Renewal: Many policies allow lifelong renewal, but premiums may rise significantly with age.

- Pre-existing Conditions: Senior citizens may have to undergo medical tests, and some insurers may impose waiting periods for pre-existing conditions, which could range from 1 to 4 years.

- Coverage for Critical Illnesses: Plans often cover illnesses that are more prevalent in older adults, such as heart disease, diabetes, and cancer.

- Higher Premiums: Senior citizen health insurance tends to have higher premiums, reflecting the increased health risks.

6. How to Overcome Age Restrictions in Health Insurance

If you’re close to the maximum age limit or find that health insurance coverage is unavailable due to your age, here are some options:

- Consider Senior Citizen Health Insurance: Many insurance companies offer customized plans for elderly individuals. These plans come with higher premiums but offer adequate coverage.

- Opt for Top-up Plans: If you already have health insurance but want to increase your coverage, consider purchasing a top-up plan. Top-up plans offer additional coverage above your base policy and may have higher age limits for purchasing.

- Choose Family Floater Plans: Some family floater policies have a higher maximum age limit than individual plans, providing coverage for senior members of the family.

Understanding the age limits for health insurance is crucial to securing appropriate coverage at every stage of life. While there are minimum and maximum age requirements for purchasing and renewing policies, health insurance options for senior citizens are widely available. To ensure uninterrupted coverage, it’s advisable to purchase health insurance at a younger age, taking advantage of lower premiums and long-term benefits.

If you are nearing the upper age limit or are looking to renew an existing policy, consult with your insurer to understand your options and ensure that your coverage continues without gaps.

Health Insurance Claim Settlement Ratio: What It Means and Why It Matters

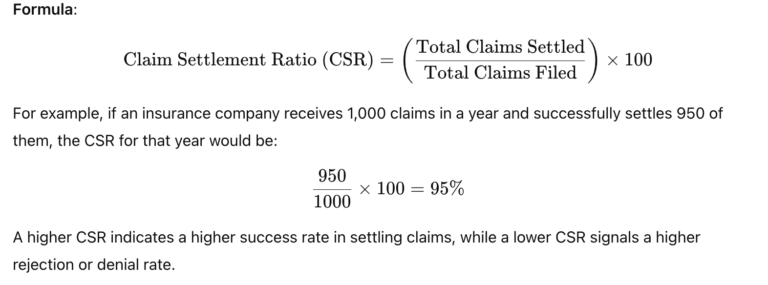

The Health Insurance Claim Settlement Ratio (CSR) is one of the most important metrics to consider when purchasing a health insurance policy. It reflects the percentage of claims that an insurance company successfully settles in comparison to the total number of claims it receives during a given period. This ratio provides valuable insight into the insurer’s reliability and the likelihood that they will honor your claims in the future.

1. What is the Health Insurance Claim Settlement Ratio?

The Claim Settlement Ratio (CSR) is calculated by dividing the total number of claims settled by the insurance company by the total number of claims received within a specific period, usually one year. It is then expressed as a percentage.

2. Why is the Claim Settlement Ratio Important?

The CSR is a crucial indicator of how efficient and trustworthy an insurance company is when it comes to paying out claims. Here’s why it matters:

- Shows Insurer’s Efficiency

A high CSR suggests that the insurer is efficient and has a streamlined process for processing and settling claims. This can give policyholders peace of mind, knowing that their claims are more likely to be approved when needed.

- Reflects Financial Stability

The CSR also reflects the financial health of the insurer. Companies with better financial resources are typically able to settle claims faster and more consistently. A low CSR might indicate financial instability or poor claim management practices.

- Helps in Claim Process Transparency

Insurers with a high CSR are likely to have a transparent and customer-friendly claim process. This reduces the chances of disputes or dissatisfaction during the claim settlement process.

- Builds Trust with Customers

A high CSR builds trust among customers. Policyholders want to know that if they need to file a claim, the company will honor it without unnecessary delays or rejections.

3. How to Use the Claim Settlement Ratio When Choosing an Insurer

When selecting a health insurance company, the Claim Settlement Ratio is an essential factor to consider. Here are some tips on how to use CSR to your advantage:

- Compare Across Insurers

Look at the CSR of different insurance providers to compare how reliable they are in settling claims. Insurers with a CSR of 90% or above are generally considered to be efficient. However, it’s essential to consider other factors as well, such as customer reviews, coverage options, and claim processing speed.

- Understand the Claim Denial Reasons

While a high CSR is a positive sign, it’s important to understand why some claims are denied. Insurers may reject claims for reasons like incomplete documentation, policy exclusions, or non-disclosure of pre-existing conditions. A high CSR doesn’t always mean that claims are denied without just cause.

- Look for Consistency in CSR

When evaluating an insurer, check their CSR over multiple years. A consistently high CSR year after year reflects a solid track record of honoring claims. If the ratio fluctuates or has seen a significant decline, it could signal issues in the insurer’s claim settlement process.

4. How to Improve Your Claim Settlement Chances

While the insurer’s CSR plays a significant role in the claim settlement process, policyholders can also take steps to increase the likelihood of a successful claim:

- Understand Your Policy Coverage

Ensure that you fully understand the terms and conditions of your health insurance policy. Familiarize yourself with the coverage details, exclusions, and the process for filing claims.

- Maintain Proper Documentation

Having all required documents in place can significantly smoothen the claim process. This includes medical bills, hospital discharge summaries, prescriptions, and any other paperwork required by the insurer.

- Disclose Pre-existing Conditions

Always disclose any pre-existing conditions at the time of purchasing the health insurance policy. Failure to do so could result in claim rejection, as insurers often have clauses about pre-existing conditions.

- Notify the Insurer On Time

Inform your insurer about the hospitalization or medical procedure as soon as possible. Most insurers require timely notification (within 24 to 48 hours) of hospitalization for claims to be processed smoothly.

- Choose a Cashless Facility

Many insurers have tie-ups with hospitals for cashless treatment. Opting for a network hospital can simplify the claim process and reduce the chances of claim rejection.

5. Claim Settlement Ratio: High vs Low

High CSR (Above 90%)

Pros:

- Indicates that the insurer is reliable in settling claims.

- Higher chances of claim approval.

- Faster claim processing.

- Greater customer satisfaction.

Cons:

- May come with slightly higher premiums as the insurer may have a higher operational cost to maintain a high CSR.

- CSR alone doesn’t guarantee hassle-free claims; checking customer reviews and feedback is also important.

Low CSR (Below 85%)

Pros:

- Often, insurers with lower CSR may offer lower premiums.

- Policies with lower CSR may still suit those with basic healthcare needs.

Cons:

- A low CSR suggests that a higher percentage of claims are being rejected or delayed.

- Could indicate issues with the insurer’s customer service or claim settlement process.

- A higher risk of disputes during claim settlement.

The Health Insurance Claim Settlement Ratio is a crucial factor when choosing a health insurer. A high CSR means the insurer is more likely to settle claims quickly and fairly, providing you with peace of mind when you need it most. However, it’s important to also consider other aspects such as customer service, network hospitals, premiums, and policy features in conjunction with the CSR. Always do your research, compare policies, and choose an insurer with a solid claim settlement track record to ensure that you and your family are well-protected in times of need.

Health Insurance Family Plans: A Comprehensive Guide

Health insurance is an essential financial tool that helps protect individuals from the rising costs of medical treatment. A family health insurance plan is one of the most effective ways to ensure that all members of your family are covered under a single policy, rather than having separate individual policies for each member. These plans provide financial support in times of medical emergencies, helping reduce out-of-pocket expenses for health care.

In this guide, we’ll explore what family health insurance plans are, their benefits, how they work, and what to consider when choosing the right one for your family.

1. What is a Family Health Insurance Plan?

A family health insurance plan is a type of health insurance policy that covers all members of a family under a single plan. Typically, this includes the policyholder, their spouse, children, and sometimes dependent parents or other relatives.

These plans work by offering a lump sum coverage amount that can be utilized by any member of the family for medical expenses during the policy period. The coverage can include hospitalization, medical treatments, surgeries, and other medical needs, depending on the terms of the policy.

Family plans are often more affordable than purchasing individual plans for each member of the family. Additionally, they provide the convenience of having a single policy to manage.

2. How Family Health Insurance Plans Work

Family health insurance plans operate on a sum insured model, which is the total amount of coverage available for the family members during the policy period. The total sum insured is generally shared among the family members covered under the plan.

For example, if a family health insurance plan has a sum insured of ₹10 lakh for the entire family, this ₹10 lakh is available for any member of the family, based on their medical needs. If one member is hospitalized and incurs a cost of ₹3 lakh, the remaining ₹7 lakh would be available for the rest of the family for the rest of the policy term.

Key Features of Family Health Insurance Plans:

- Family Floater Plan: The coverage amount is shared among all family members, and the premiums are often lower compared to buying individual policies for each member.

- Individual Coverage: In some family plans, each member can have a specific sub-limit for coverage, though the total coverage amount is still shared.

- Add-on Benefits: Family health plans often offer add-on benefits, such as maternity cover, critical illness coverage, and wellness programs, which can be beneficial for the entire family.

- Cashless Network Hospitals: Many family health plans provide access to a network of hospitals where treatment can be received without upfront payment, making the claims process easier.

3. Benefits of Family Health Insurance Plans

Opting for a family health insurance plan can bring numerous advantages. Here are some of the key benefits:

- Cost-Efficient

Family health insurance plans are generally more affordable than purchasing separate policies for each member. Insurance providers offer discounted premiums when covering multiple members of the same family under a single plan, making it a cost-effective option for families.

- Convenient and Simple

Managing a single policy for the entire family is much easier than managing multiple individual policies. With a family health insurance plan, you don’t need to remember different renewal dates or manage multiple documents, as everything is centralized.

- Comprehensive Coverage